Exchange Matching Engine Solutions

GMEX delivers innovative, integrated, end-to-end exchange matching engine technology (ForumMatch), which supports multiple asset classes, including Equities, Debt, FX, Derivatives, Commodities, Security Tokens, and Digital Assets.

Key features of the ForumMatch exchange matching engine include:

- A proven, robust, scalable, ultra low-latency, high-throughput order matching engine designed to meet regulatory approvals;

- FIX integration as well as a low latency API for market markers/ liquidity providers;

- Open-source technology stack that will reduce the cost of operational licences and on-going support;

- Experience of implementing different trading models and matching algorithms;

- Flexible and customisable system that addresses the specific requirements of the market;

- Ability to handle traditional assets with extension to support digital assets and tokenised traditional assets such as commodities;

- Full technical support and guidance;

- Choice of on-site deployment or fully managed software-as-a-service (SaaS) solutions for quote, auction and order driven markets supporting both global and local regulation;

- Management of client connectivity;

- Ability to run standalone or integrate with other liquidity pools;

- Integrated market surveillance service with exchange trade reporting as required to ensure high levels of compliance and regulatory oversight appropriate for institutional trading;

- Seamless integration with CCP or CSD clearing and digital custody; and

- Supporting clients across the globe with individually customised solutions.

The ForumMatch trading platform with integral exchange matching engine supports the following trading models:

| Model | Description |

|---|---|

| Central Limit Order Book | Transparent order matching based on price-time or an alternative algorithm. |

| Block Book | Particularly suited for building a dark pool of large blocks |

| Request for Quote | Targeted session that solicits best price and allows additional workup |

| Auction | Scheduled time slots when trading occurs following a period of orders being placed – may also publish an indicative. The uncrossing algorithm is designed to maximise trading levels. |

| Issuance | Auction at fixed price with rules on cancellation buffer. Can be staged to have different price points |

The above, coupled with our deep domain knowledge of exchanges trading platforms and post trade systems, makes us an ideal partner.

Exchange Matching Engine FAQs

A matching engine is a type of trading software that uses algorithms to analyse trade information and match suitable bids and offers to execute trades.

Advances in exchange matching engine technology have transformed trading in multiple asset classes. Investors no longer need to queue on exchange floors and trade face to face. An order matching engine enables high-frequency trading using a complex algorithmic system. Nowadays exchange trading is almost fully enabled by intelligent matching engines.

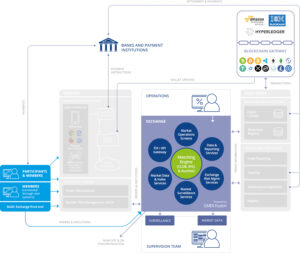

As part of an exchange trading platform, a matching engine integrates with banks, payment institutions and liquidity providers via a low latency API.

Investors submit buy and sell orders via the API.

When an investor is looking to buy a certain asset class and another investor is selling that particular asset class at the right quantity and price, the matching engine will identify the match and process the transaction. The orders are compatible if the buyer’s maximum price exceeds or equals the seller’s minimum price. Whilst the most popular matching algorithm is on the basis of price time priority, some models facilitate size priority and pro rata matching algorithms.

GMEX offers both on-site deployment or a fully managed software-as-a-service (SaaS) solutions for quote, auction and order driven markets with ability to also deploy into multiple types of cloud environments. On average it takes 3-4 months to implement, test and deploy the complete ForumMatch trading system with its integral exchange matching engine. Integration with ForumMatch can be achieved through standard FIX and high-speed binary APIs with exchanges and trading venues usually having a test cycle of 1-2 months for a new project. The time for trading participants to connect can be hours to a matter of days depending on their own capabilities.

Our ForumMatch trading system with integral matching engine is suitable for exchanges, trading venues and marketplaces handling multiple asset classes. These venues can facilitate a broad range of participants into ForumMatch including market makers, liquidity providers, banks, asset managers and payment institutions.

Does ForumMatch come as one complete solution, or can we purchase only the functionality we require?

GMEX’s ForumMatch matching engine is fully customisable. It supports multiple asset classes, including Equities, Debt, FX, Derivatives, Commodities, Cryptocurrencies, Security Tokens, and other types of Digital Assets including Non Fungible Tokens (NFTs).

In addition to order driven trading, the ForumMatch exchange matching engines can also handle auction trading, Request for Quote trading, and block book trading for large transactions.