Post-Trade Solutions

Customisable clearing house & depository platforms

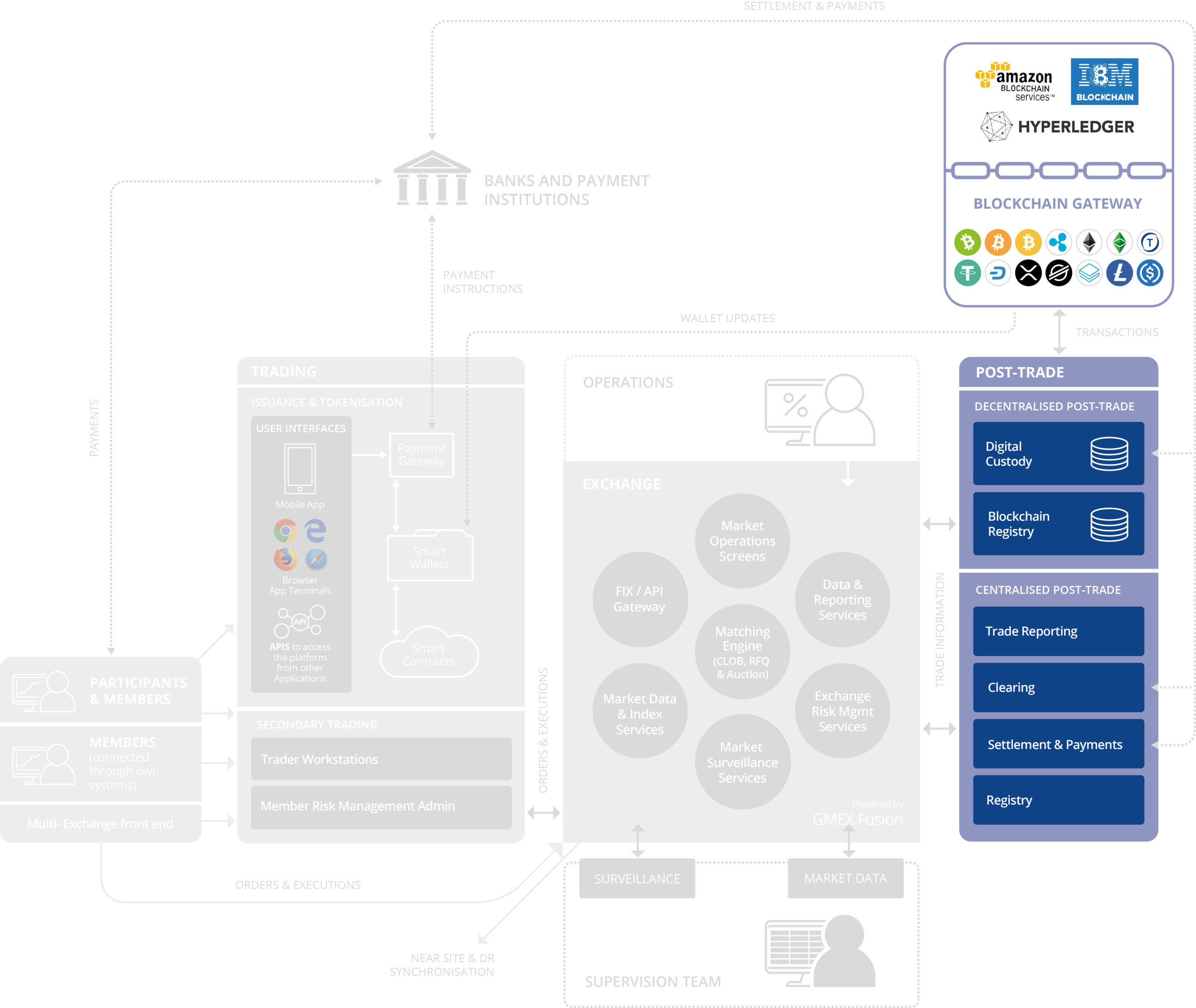

GMEX Technologies provides locally deployed as well as managed post-trade services. Supporting clients across the globe with individually customised post-trade market infrastructure solutions.

Key features include:

- Post-trade market infrastructure solutions including post-trade software and post-trade technology

- Choice of on-site deployment or fully managed solutions supporting both global and local regulation

- Outsourced management of client connectivity

- Ability to run standalone or integrate with other solutions

- Multi-asset options

- Seamless integration with trading platform

GMEX Technologies delivers the following robust, flexible and cost-effective post-trade technology, products and services to international standards:

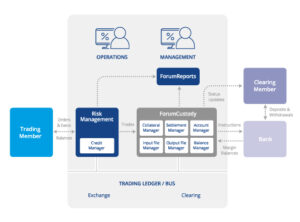

ForumCCP for Clearing Houses and Central Counterparties (CCPs).

Delivering real-time clearing, settlement and risk management of financial and digital assets including:

- Technology – post-trade clearing and settlement platform

- Trades – validation, enrichment and novation

- Position management – trade netting and give-up / take-up

- Risk Management and Collateral – initial and variation margin

- Default Management – tools to support the CCP operator during a default scenario

- Initial Margin Calculation – options for calculating initial margin

The core features of ForumCCP include:

- Account Management – Account structure functionality

- Instrument Management – Universe of traded products and contracts per exchange/market

- Trade & Clearing Flow – trade registration: validation, enrichment and novation

- Position Management – account allocation, trade netting and give-up/take-up

- Credit Checking and Risk Management – multiple robust credit, margin, and collateral management tools

- Fee Management – including transactional fees, membership fees, interest charges and collateral management

- Default Management – tools to support the CCP operator during a default scenario

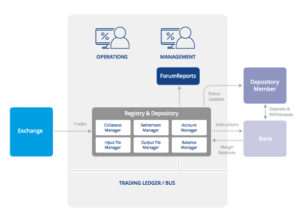

ForumCSD for Custodians, Central Securities Depositories (CSDs) and Registries.

Delivering real-time registration, clearing, and settlement of financial and digital assets as well as enabling inter-bank message flows to facilitate settlement and provides balance updates to front-end Order Management Systems (OMS) and exchanges for pre-trade risk management.

Both systems interface with an exchange or trading venue and have a range of options for external user connectivity including ActiveMQ and Hyperledger as message buses, as well as FIX for the real-time message flows, in addition to RESTful API for intraday reference data updates.

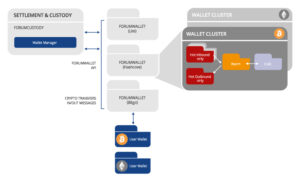

ForumCustody / ForumWallet – custody and wallet management software and technology for Exchanges, Custodians, Central Securities Depositories (CSDs) and Registries.

A permissioned blockchain platform designed for settlement, custody, and management of traded digital assets.

The solution supports the safe custody of a broad range of digital assets, including security tokens for customers choosing to secure their digital assets, with robust layers of security to prevent fraud and misappropriation.

ForumCustody can be deployed to service the digital custody needs of both private and institutional clients (including third party exchanges, marketplaces and financial institutions), by handling:

- Custody;

- Escrow services;

- Automated transfers;

- Balance confirmations; and

- Account related requests.

This solution also supports inter-bank message flows to facilitate settlement, and provides trade data from the exchange trading platform to facilitate balance updates to front-end Order Management Systems (OMSs).

It can be hosted and run independently from the trading system, with direct blockchain adaptor interface to the Ledger allowing connectivity between different nodes. It can handle regulated and real-world digital assets and digital tokenised assets.

The system sets up standard digital asset wallets or interfaces with third party wallet subsystems for receipt of incoming coins and transfer out of coins to standard digital assets wallets. ForumCustody has the ability to manage internal balances as well as lock requests to withdraw until granted.

ForumWallet for Custodians and Exchanges.

A secure digital custody wallet management platform, which is integrated with ForumCustody.

It can be deployed by an exchange or custodians linking to either their own internal digital asset storage, external providers or wallet sub-systems.

Or

It can be deployed by an exchange or third-party custodians linking to their internal digital asset storage; or by external third-party providers looking to provide wallet sub-systems.

All wallets are created automatically and managed by the ForumWallet subsystem (and are never deleted). Wallet keys are stored with strong encryption with periodic key rotation. Key backups are also stored with strong encryption and so available if needed for recovery. Rotation is configurable (currently day/week/biweekly).

The digital asset wallet and settlement framework can also be utilised to tokenise existing securities and assets as well as facilitate deposits into internal hot, warm and highly secure cold storage wallets with subsequent trading and withdrawals into external wallets as and when required.