Hirander Misra, Chairman and CEO of GMEX Group and MINDEX

In order to generate development and innovative change, we must question and challenge what is already before us. It is not as simple as taking the next step up the ladder or adding to what you already have, it is about stripping a business model back to the basics, clarifying what you want to achieve and doing so by taking a completely different path.

So what does this mean in the context of exchanges and financial market infrastructure? A good place to start is to learn from the past to see what might happen in the future: After the emergence of electronic markets, exchanges, for some time, became complacent towards innovation and the idea that there would be any real competition. Then regulation became more demanding, forcing the exchanges to react and creating opportunities for start-up trading venue firms with progressive ideas and ‘disruptive’ technology to bring new solutions. Interestingly, regulation could also be viewed as ‘disruptive’ as it was the driving force which pushed the exchanges to adopt new innovations and adapt in conjunction with the market.

But what happens next in terms of evolution? We have seen the fast emergence of blockchain being applied to the exchange and post trade space with advocacy of decentralised and centralised exchanges in abundance. Once you cut through all the hype there are some interesting use cases now being productionised. Having said that it seems like every other day there is a new announcement about yet another initiative wanting to become the next Binance or a game-changing institutional crypto exchange, with some wanting to become a combination of the two. Some will certainly succeed and that will be predicated on good technology, a sound business model and ultimately a good balance of liquidity. Yet one thing is clear and ironic, the majority of these exchanges whilst advocating decentralisation in their marketing materials and white papers are still centralised. Thus essentially the exchange construct is no different now than it was a number of decades ago when electronic markets came into being.

Once a technological system is in place a problem of inter-connectivity exists. Some of the new emerging exchanges and existing smaller and medium size exchanges simply do not have the expertise to innovate in their own right and are buying the technology off the bigger exchanges in the belief that everyone is connected to their system. These systems are also often marketed as being digitally enabled. But if you look at this large and expensive piece of technology much of it dated – no matter how you wrap it up or market it, providing just a matching engine, which does not make it a digital exchange solution as there is no post trade offering for digital assets. It is deployed into these exchanges standalone, so it’s akin to being landlocked and isolated where ships of liquidity can’t sail to. If each exchange has its own system connected to their market, they are effectively detached entities which are unable to help new markets grow and increase liquidity. This is true of traditional exchanges and most crypto exchanges today.

In terms of trading crypto and wider digital assets, it requires much more than just offering up a matching engine and it amazes me how excited people can get about this single aspect. Whilst it’s important that the trading system can handle 24 by 7 trading, and quirks such as 8 decimal places for quantity and price which do not exist in normal markets, the trading platform with its integral matching engine is simply the support actor in this movie. The stars of the show are managing wallets securely as well as ensuring trusted custody and settlement of these digital assets.

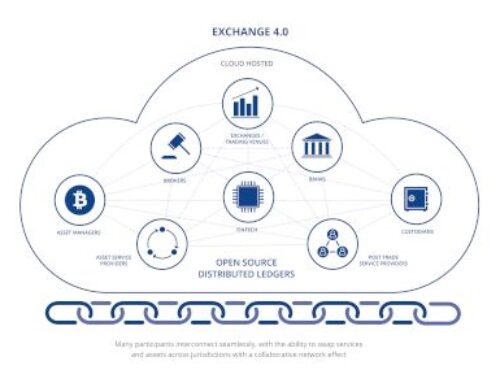

The next wave of business models in the crypto and digital space are all about partnerships and innovation; it’s key to work with these markets in a way that they interconnect and grow. By creating a network of interconnected exchanges and markets, liquidity can be provided and new opportunities can arise. Blockchain certainly makes this interconnectivity possible yet today there are multiple blockchains with scant interoperability between them. Add to this the complexity of new blockchain-based networks and existing legacy networks having to run in parallel. The landscape is changing fast and both new and existing exchanges and market infrastructure operators need to understand how they can capture the opportunity that arises from it.

True Tokenomics is about having the foresight, innovation and interconnectivity to create a network effect. This is turn will create multiple opportunities, with partnerships magnifying the positive impact leading to increased value – delivering “Token Augmenting Partnerships” (TAP).

It is evident that exchange and financial market infrastructure model 1.0 will become extinct over the coming years as standalone exchanges will not be able to survive. Can we think of an era before the smart phone, which has democratised the way we can access and generate information? Today’s exchanges are essentially like the phones that existed before this era, not an iphone whose creator Apple is seen as an innovator which provides knowledge rather than a supplier of technology, thus commanding a premium for its products and services and being able to distribute and commercially benefit from third party services.

Model 2.0 is all about leveraging blockchain to create digital opportunity across jurisdictions without traditional intermediaries, who will need to reinvent themselves rather than just protect their turf in this new digital era by merely creating new ways of doing old things. It will allow exchanges to interconnect directly should they be willing to. This will facilitate asset swaps and general trading in tokenised form across a broad range of assets beyond just cryptocurrencies. This can include digital gold aligned to safe physical storage; security tokens with the ability to settle using stablecoins and digital fiat currencies using secure digital custodians aligned where applicable to physical assets and segregated cash on account held in escrow.

This is not a pipe dream as it is already playing out faster than most envisaged with appropriate market surveillance, credit checking, position keeping and margining being more predictive and proactive, linked to the exchange trading platforms as opposed to just being reactive post trade. Central Counterparty Clearing House 2.0 or “CCP light” is also very much now in the movie frame. This is going to replace the “wild west” nature of the first wave of crypto exchanges with the second wave of institutional grade digital exchanges that stand up to regulatory scrutiny across a multitude of jurisdictions.

It is time for traditional as well as crypotcurrency exchanges and market infrastructure operators to wake up and smell the coffee; which means not just doing their own thing but also realising, in this new digital age, the way for them to succeed is to open up the TAP to facilitate business opportunity with the right technological enablement. Let the matrix continue to expand, mesh and interconnect so that the all star cast of digital enablement is available and accessible for the market infrastructure masses if they want it to be and know where to really look to make the predecessor to exchange 1.0 a success and not a flop of missed opportunity. Digital Exchange 2.0, the much anticipated sequel.